Tax Deductions For MLM’ers

If you are currently someone’s employee and don’t own a home that you can use for tax deductions, and you are not already in a Network Marketing business of your own… … make it your business to find a home based business to get into. When I say home business… I mean direct sales/ network marketing, btw.

I’m sure you guessed that though… =)

Anyway… Running a home business is the best way to get some of those needed tax advantages that you would get as a home owner and then some. Whether it’s the latest yummy shakes, juicy juice, or anti-aging youth serum, get involved in a home business of your own that you resonate with.

On average it can save you $500-$2,000 or more with the new tax changes on the horizon. Once you’ve decide that creating a business is for you, there are many things that are involved that must be taken seriously.

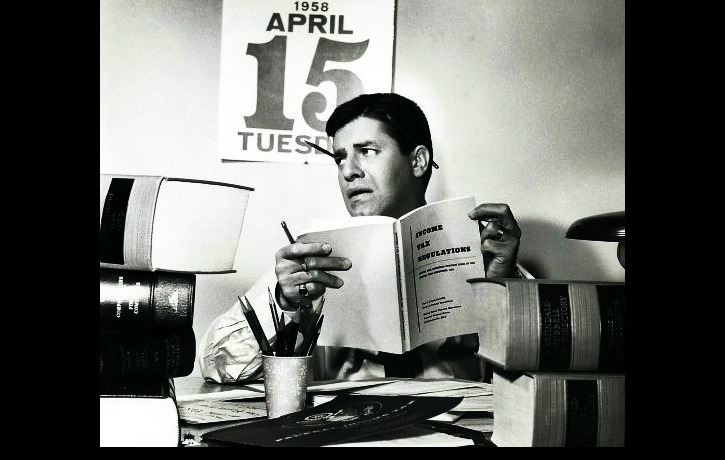

There are a myriad of expenses associated with running a home business, but the good news is, many of them can be used as tax deductions for your household. I’m going to highlight just a few of the things that you will be able to write off when April 15th rolls around.

Here we go…

Tax Deductions for Office/Business Supplies

First off let me just reiterate, if you have a home based business, you must designate a separate area used solely for business purposes. If ever you get audited by the IRS, you’ll need to prove that you have this space laid out for your business affairs.

That being said, when you have to purchase office supplies for your new biz, you will be qualified to write the majority of these items off. It may not be sensible to write off every single marker, pen or paper clip, but items like fax machines, copiers, computers, or any business software needed to build your business should definitely be included.

If you have monthly auto drafts for particular services you use to promote your business, it can add up to quite a bit of money at the end of the year…

Write it off!!

The key is to only write off things that are used solely for business purposes.

Tax Deductions for Trade Magazines

My particular MLM business has a trade magazine that we can use to promote the opportunity, but even if your company doesn’t offer one, there are magazines out there created for the sole purpose of educating you about your trade.

In order to succeed in your business, you may need to read a few if you want to keep up with what’s going on in your industry. While the Internet has a lot of information, it would not hurt you to subscribe to a few of these trade magazines.

If the magazines you purchased satisfy a genuine need for you to run your business effectively, then guess what? These subscriptions can be written off as well.

Tax Deductions for Your Phone Bill

If you are in any type of business you are well aware of how important your phone is. Whether you’re calling or texting, without it, your business will never get off the ground.

Although you cannot write off your entire bill from your taxes, you can write off your service if it isa dedicated business line. If you have added a second phone line to your account to be used for business only, which is highly recommended, that is deductible.

Tax Deductions for The Internet

Can you ever imagine a time where people actually performed business affairs without the world wide web? Thank goodness for technology! The Internet is another expense that can be written off if you use it for business alone.

Now, if you spend countless hours shopping online and only one hour doing business related work on it, then please don’t attempt to deduct that.

If on the other hand, you have a laptop that you use for business purposes (including Social Media Marketing), and not for any personal reasons, it’s perfectly ok to add your online usage as a business expense.

Tax Deductions for Shipping Charges

Have a tangible product that you sell as part of your business? Then you are allowed to deduct any money that you use in order to ship your products to people.

However, if you only use shipping services every once in a while, it will not make much of a difference on your tax deductions, but if you use it quite often, the ability to write it off can save you a ton of money.

Keep all of the receipts you give from making shipments and any other related cost you may incur in the process.

Tax Deductions for Training Courses

Did you know you can write off courses that you pay for in order to learn more about your industry?

It’s true!

Building a business means investing in yourself. It means taking the time and money to learn your craft so that you can be more productive in your business.

I set aside a budget each year to spend on courses that are going to help me become better at my biz. And then, at the end of the year I can write them off.

Obviously these training courses have to be specific to your business.

Some examples, Social Media marketing courses, website building, learning how to use online tools to get more leads for your business, etc.

Don’t be afraid to pay for training courses, they will help you and your wallet in the long run!

Tax Deductions for Gas Mileage/ Business Meetings

Many people make the mistake of forgetting to deduct mileage when they file their tax returns. If you use your car for anything that relates to your business, for example, dinner meetings, product deliveries, and even some recreational events as long as your business is somewhere in the topic of your conversation, you can deduct it!

How awesome is that?!

The most important thing to remember is to always document everything that you do that is related to your company. You must keep accurate records in case there are any questions later on. Many people do not realize that being in a Direct Sales company is considered a valid, tax deductible business operation, so take advantage of the opportunity.

Also, when people you approach about your business complain about the cost of operation, let them know of the tax benefits. If they still complain… Kick’em to the curb!… These kinds of people are only looking to win the lottery NOT being an actual business owner.

Again, these are just some of the things you can deduct at the end of the year. I am not a tax adviser so I suggest you consult with your local tax person for more information on the possible tax deductions you can write off in your business.

‘Till Next Time! April =)

P.S If you're feeling stuck in your business even after you did everything your upline told you to do... Take a minute to Check out my 3 Step Marketing Blueprint to learn how to start marketing your business without feeling like a pushy salesman. CLICK HERE TO WATCH

April Ray

CEO/ Founder

If you enjoyed this article, leave me a comment and share with your besties! =)

Email: april@theintrovertmogul

Ph: (619) 537-9864

"As an introvert entrepreneur I don't particularly enjoy chasing strangers online, networking events, talking about myself on social media or anything else you can think of that involves selling! But, because I learned how to market online the right way, I don't have to do those things."

↓Check Out More. Comment and Share↓

Ok totally bookmarked and will need to re read slowly! BOOM!

Great post on tax write offs. I’m going to create a folder in put your blog in. Thanks for sharing.

Awesome, I’ve taken note of these tax deduction tips, April. Thank you for sharing.

The Cell phone tip was huge! Will look at creating my primary cell phone as a dedicated business line

Dr. Lisa

Those are some great tips April. I love the idea that nearly everything in my home business can be offset against my tax. Thanks for sharing such valuable information..

Lol! Thanks Socrates! =)

Thank you Annabel!

Thanks for commenting Sherri!

Thanks Lisa!

Thanks Keith!